About | Issuers | Terms and Conditions | FAQs | Terminology | Callable CDs

Terminology: Learn More About CD Investments

Your Single Source for Certificates of Deposit

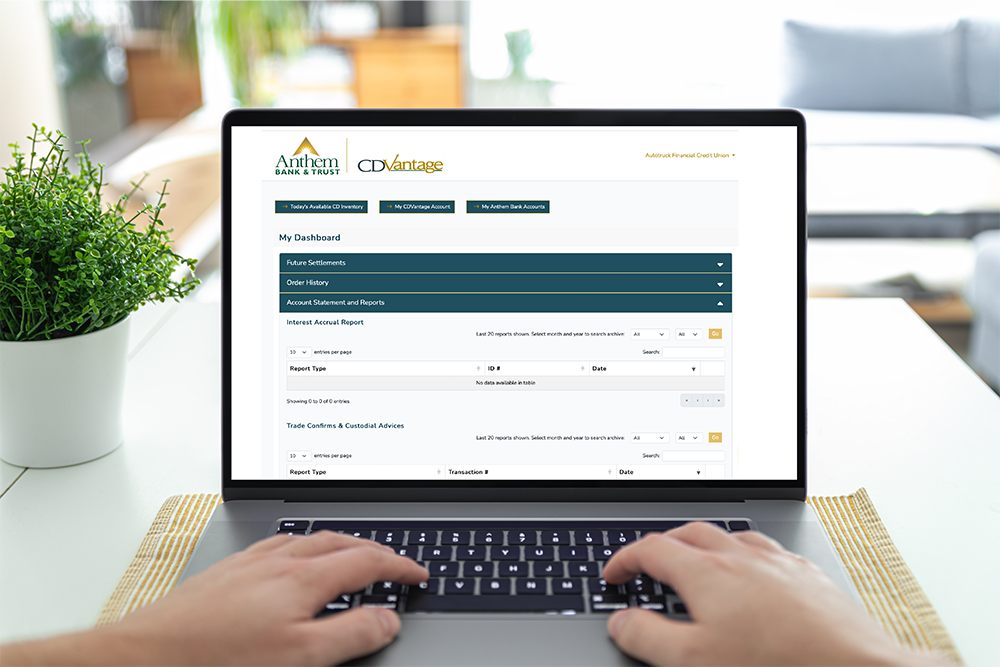

The CDVantage product is built for CD investors -- providing an efficient and secure way to purchase and manage an entire portfolio of Federally-Insured Certificates of Deposit. Purchase CDs from multiple issuers nationwide, manage and receive all reports in one secure online platform.

Anthem Bank Home | CDVantage | About CDVantage | Terminology

Learn More About Certificates of Deposit Investments

Certificate of Deposit - A Certificate of Deposit or CD is a time deposit at a financial institution (bank, thrift or a credit union). When you decide to buy a CD, you basically agree to deposit money with the financial institution for a set amount of time (6 months, 1 year, 2 years, 5 years or more). In return, the financial institution contractually agrees to pay you a set amount of interest periodically throughout the CD holding period and they also agree to return your initial deposit back to you at the end of the holding period. You are the lender and the financial institution is the borrower. (see "Tips For Investors" published by the SEC)

A CD is a debt-obligation of the financial institution; moreover, since CDs are truly "deposits" of a financial institution and are FDIC insured up to the maximum limit of the law, generally up to $250,000 per institution. (See FDIC Insurance for more details including permanently raising the maximum limit on 07/21/11)

The standard CD pays a pre-determined interest rate (fixed) at pre-determined intervals (monthly, quarterly, semi-annually, etc.) and pays back the initial deposit at the pre-determined end date (maturity). It is important to recognize that there are many variations on the standard CD structure: callable CDs, floating-rate coupons, zero coupon, etc. Make sure that the CDs you purchase are the type of structure best suited for your investment needs.

Par Value - referred to as the "Amount" on the CDVantage inventory offering sheet and also referred to as the principal amount or face value, the par value represents the amount of CDs owned or offered. The par amount represents the amount to be repaid to the investor at maturity and the amount on which the interest (coupon) payments are calculated. CDs typically trade in increments of $1000 par value.

Issuer - The financial institution (bank, thrift, or credit union) providing the CD. The issuer is responsible for making all contractual payments due to the CD holders. All CD issuers posted on CDVantage are FDIC insured; accordingly, the CDs of these issuers are insured by the FDIC up to the maximum amount permitted by law.

Rate - The interest rate the issuer pays to the CD holder until the CD matures. The rate is expressed as an annual percent of par value. For example, if you owned $100,000 par value of a CD with a 7% rate, you should expect to receive interest payments totaling $7,000 over a one year period.

Compounding Frequency - Compounding refers to the interest you earn on your interest payments when those interest payments are reinvested. Over time, compounding can have a significant effect on the overall dollars you receive. Compounding frequency tells you how fast the interest you've earned is credited to your account and begins earning interest or, as in the case of CDVantage CDs, how quickly (frequently) interest payments are made to you so that you can reinvest them and begin earning interest on your interest.

Payment Frequency - CDs vary in their payment frequencies, with many paying monthly, while others pay semi-annually, quarterly or at maturity.

Maturity - The date on which a CD's principal becomes due and is paid back to the CD holders of record; CD holders no longer receive interest payments after maturity.

Approximate Term - The approximate time to maturity stated in months. It is calculated by determining the number of days between today's date and the maturity date and dividing that number by 30 (approximate days in the month).

Call Features - Some CDs provide the issuer with the option to redeem an outstanding CD prior to the stated maturity date. These CDs are referred to as callable CDs. CDs with no call provision are generally referred to as non-call or bullet CDs. CDVantage will clearly distinguish between the two in order to insure you get what you want. The timing and prices at which a CD can be called are different for each callable CD. An issuer's decision to call a CD may depend on numerous factors, but is normally based on the prevailing level of interest rates and a corresponding assessment of whether or not the issuer would benefit economically from refinancing the CD. Call options tend to be exercised in periods of falling interest rates, a time when the investor would generally prefer to hold on to his/her above market rate. The CD holder may be forced to reinvest at lower rates when his/her CD is called. Given the potential reinvestment issue associated with callable CDs, callable CDs should normally trade at higher yields (lower dollar prices) than otherwise identicle non-call CDs in order to compensate CD holders for the added risk associated with callable CDs.

Trade Date - The date that the transaction is agreed to by both parties. For trades initiated on the CDVantage site, the trade date will be the date on which the CDVantage representative accepts a CDVantage customer order. Operating hours are 8:30am-5pm, EST (M-F).

Settlement Date - The date ownership of the CD transfers to the new owner and the date on which the buyer must pay for the CD. The buyer begins to earn interest from this date forward. All CDVantage CDs offered will show the earliest date in which settlement can occur.

Accrued Interest - A common term even though it will not be an issue for purchases made through CDVantage. CDs pay interest periodically. When a CD is purchased on a date that falls somewhere between the two payment dates, which, as you might imagine happens all the time, the CD will settle with accrued interest. Accrued interest is the interest that accumulated from the last coupon payment date up to the settlement (sale) date. The buyer pays the seller for the CD and also pays for the accrued interest. At the next coupon payment date, the buyer essentially gets the accrued interest back and receives the additional interest accumulated during the remainder of the payment period.

Price Quotes - CDVantage offerings generally trade at par, just like the CDs you might purchase at your local bank, e.g. $100,000 of a CD will cost $100,000. Some CDs, in particular Discount CDs, do trade at prices that differ from par. In this situation, the CD's price is generally quoted at a percent of par value. For example, if you were to purchase $100,000 par value of CDs at a dollar price of $98.50, your cost would be $98,5000 (98.50% of $100,000). You would receive interest payments based on the par value ($100,000) and you would receive $100,000 at maturity in addtion to your periodic interest payments. CDs trading at $100 (100% of par value) are commonly referred to as par bonds. CDs trading below $100 are commonly referred to as discount CDs. Discount CDs are CDs issued with below market rates.

Yield - There are numerous methods used to project the potential return on an investment. The most common are current yield, yield-to-maturity and yield-to-call and annual percentage yield (APY). Each method has its' benefits and drawbacks.

Current Yield - Annual coupon rate divided by the price of the CD. For example, a CD with a 7% coupon that sells in the market at 95. The current yield is: 7 divided by 95 = 7.36%. The current yield calculation represents the percentage income return (dollars in versus dollars received annually) at a given point in time.

Yield-to-Maturity - Acknowledged as the best calculation for determining an investor's potential return on a CD if that CD is held to its maturity. It takes into account the price (discount, par or premium), the coupon payments, the maturity date, the timing of these various interest payments and the interest-on-interest effect in calculating the return.

Yield-to-Call - Same as yield-to-maturity except that it assumes the bond will be called at its first call date and it utilizes the call price stipulated in the CD indenture in lieu of the maturity redemption price.

Annual Percentage Yield (APY) - Established by the Board of Governors of the Federal Reserve System for the uniform quotation of deposit interest rates. The APY is the yield your deposit will earn over the term of a year. It refers to your income earned. The APY is unique because it takes compounding into account. Compounding is the process of receiving interest-on-interest. The quoted APY tells you how much you are actually making on your money.