About | Issuers | Terms and Conditions | FAQs | Terminology | Callable CDs

CDVantage Frequently Asked Questions

Your Single Source for Certificates of Deposit

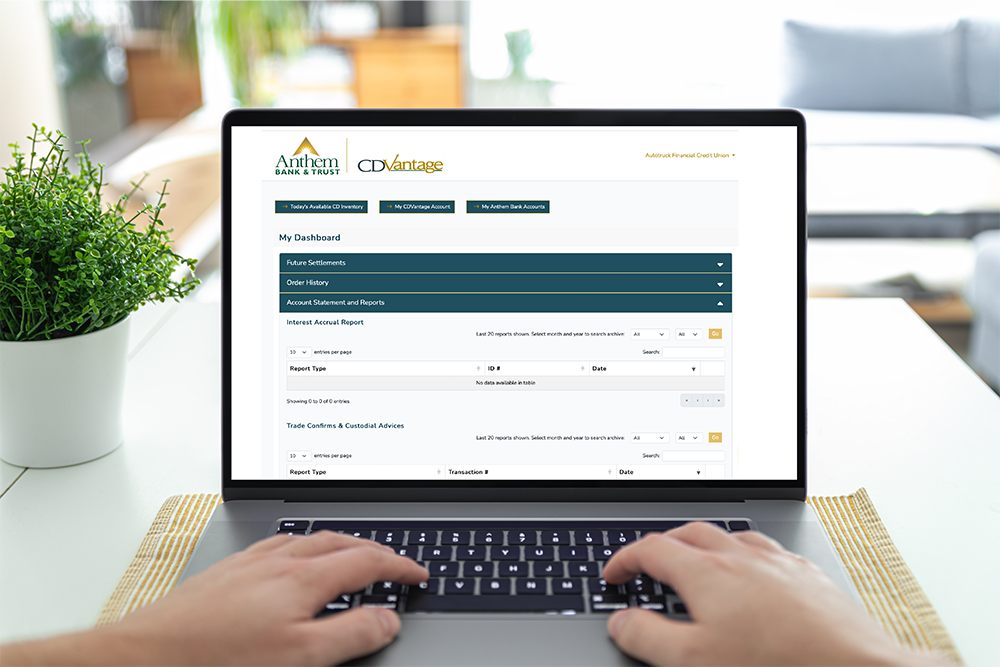

The CDVantage product is built for CD investors -- providing an efficient and secure way to purchase and manage an entire portfolio of Federally-Insured Certificates of Deposit. Purchase CDs from multiple issuers nationwide, manage and receive all reports in one secure online platform.

Frequently Asked Questions About CDVantage

Dedicated customer service is our priority and large benefit of the CDVantage program.

Below are commonly asked questions about CDVantage from Anthem Bank & Trust. For more questions, please click the Live Chat below to talk to a CDVantage representative. All CDVantage customers have direct access to a dedicated account manager by phone, email, and live chat.

Question: Why should I purchase CDs through Anthem Bank & Trust (ABT) and not from my own local bank?

Answer: ABT account representatives are actively searching the national CD market for the most attractive offerings every day, virtually bringing the national market to you. Access to financial institutions from across the nation means you can efficiently diversify an FDIC insured CD portfolio maximizing your returns.

Question: Are there any commissions or fees associated with my purchase?

Answer: No, our investors do not pay any fees. Most of the CDs available through ABT represent an interest in a larger CD. The rate of interest payable on the CD interests sold to customers is ordinarily less than the rate of interest paid on the larger CD. Additionally, ABT may acquire CDs that offer broker/dealers a selling concession and therefore, ABT may retain selling concessions as compensation for its services. Except for the interest payable on the larger CD which ABT retains as compensation for its services, no other commissions or fees on the sale of these CDs is assessed to the customer. When you see our quoted rates, they are the rates that you receive on your CD investments!

Question: If I purchase a CD through ABT, do I maintain control of my investment?

Answer: Yes. All transactions, changes or instructions must be authorized by you.

Question: What does a Custodial Certificate CD mean?

Answer: ABT offers custodial safekeeping services for all the CDs purchased. CDs are titled in the name of ABT as custodian and ABT provides the custody services for all the beneficial owners of the CDs.

Question: How do I contact an account representatives after I purchase a CD?

Answer: Anytime you have a question or concern, our representatives are available via phone or email, whichever you prefer. The Contact Us page, as well as all customer correspondence, has all the info you need to get in touch with us.

Question: How secure are my investments with ABT?

Answer: All CDs sold through ABT are insured by the FDIC (or the NCUA for credit union issued CDs) and are subject to applicable FDIC (NCUA) limits. Furthermore, as a condition of issuance, each institution must meet FDIC guidelines governing the issuance of brokered deposits. FDIC insurance means that your investment is backed directly by the Full Faith & Credit of the United States Government to the full extent of the law. Of course, ABT is an OCC regulated savings institution and all CDs are held in the bank's custody department.

Question: The CD is FDIC insured even though its being held by the custodian, ABT?

Answer: Thats right, your CDs are FDIC insured to the maximum amount allowable by law.

Question: What do I receive as proof of my purchase?

Answer: You will receive a purchase confirmation from ABT and a custodial receipt from ABT for each CD purchased. The purchase confirmation evidences the satisfied order and the custodial receipt evidences the transfer of the CD to our custodial department.

Question: After I purchase the CD through ABT, when will I begin to earn interest?

Answer: Interest begins to accrue on the settlement date and will be paid according to each CDs payment schedule.

Question: How do I settle my CD purchase?

Answer: Your ABT account representative will provide you with the settlement details prior to settlement date. These details will include the actual total funds required as well as the account information for the settlement account at ABT.

Question: What if my institution has more money to invest in FDIC insured CDs than the amount of CDs listed on your Inventory List?

Answer: ABT can and regularly does, customize purchases for customers. Whether it is to invest several million, create a specific ladder or to find issuers with certain balance sheets, ABT will accomodate your requests. Just contact your account representative.

Question: Are there any other resources that I can access to get answers to more questions that I have regarding CDs?

Answer: Yes, the Securities and Exchange Commission (SEC) produced a guide to CD investing that is posted on their website. Click here to be redirected to the article on the SEC website.