About | Issuers | Terms and Conditions | FAQs | Terminology | Callable CDs

CDVantage: Callable CDs

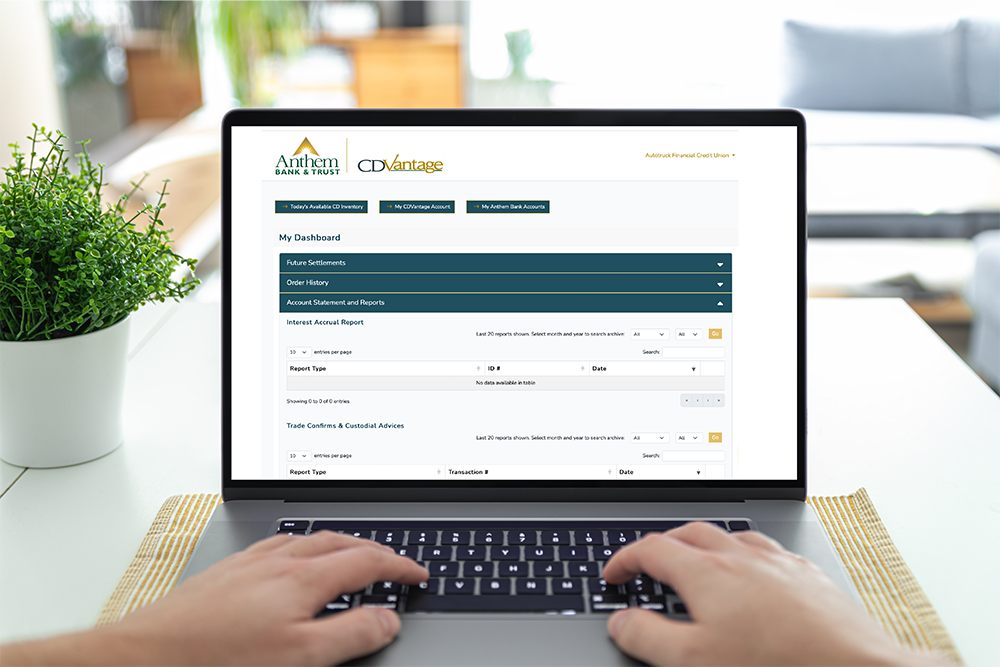

Your Single Source for Certificates of Deposit

The CDVantage product is built for CD investors -- providing an efficient and secure way to purchase and manage an entire portfolio of Federally-Insured Certificates of Deposit. Purchase CDs from multiple issuers nationwide, manage and receive all reports in one secure online platform.

Anthem Bank Home | CDVantage | About CDVantage | Callable CDs

We don't currently list Callable CDs on our public-facing live inventory.

Please contact us to discuss callable CDs.

Callable CDs may not be suitable for all investors. Typically, a callable CD has a long stated final maturity but may be "called" or redeemed by the issuer on a date earlier than the stated maturity. As a result, there are a number of associated risks with callable CDs that are different than those associated with a fixed term CD. These risks are, but not limited to; Market Risk, Call Risk, Re-Investment Risk, Interest Rate Risk and Secondary Market Availability Risk. See below for more on callable CDs.

Callable CDs | Call Features - Some CDs provide the issuer with the option to redeem an outstanding CD prior to the stated maturity date. These CDs are referred to as callable CDs. CDs with no call provision are generally referred to as non-call or bullet CDs. CDVantage will clearly distinguish between the two in order to insure you get what you want. The timing and prices at which a CD can be called are different for each callable CD. An issuer's decision to call a CD may depend on numerous factors, but is normally based on the prevailing level of interest rates and a corresponding assessment of whether or not the issuer would benefit economically from refinancing the CD. Call options tend to be exercised in periods of falling interest rates, a time when the investor would generally prefer to hold on to his/her above market rate. The CD holder may be forced to reinvest at lower rates when his/her CD is called. Given the potential reinvestment issue associated with callable CDs, callable CDs should normally trade at higher yields (lower dollar prices) than otherwise identicle non-call CDs in order to compensate CD holders for the added risk associated with callable CDs.