ideal for cd laddering, streamlined reports, diversification, and securing principal

Personal, Corporate, Institutional, Trust, and Custodial Investors::

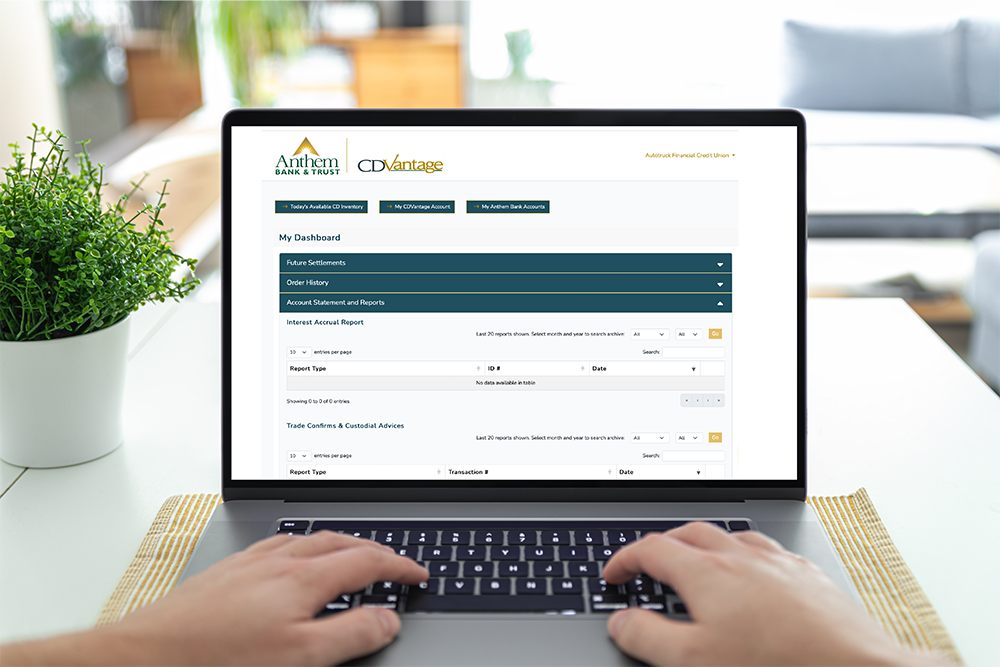

CDVantage has been serving personal, corporate, custodial, trust and institutional accounts for over 25 years. For all investors, including those with a fiduciary responsibility to preserve capital, CDVantage offers a unique way to secure principal, earn competitive returns, diversify deposits, maximize federal deposit insurance, and streamline administration. This includes easily purchasing CDs from nationwide issuers from a single CDVantage account, receiving all reports and year-end tax documents in one secure CDVantage dashboard, viewing and managing a variety of maturities with monthly CD Ladder reports, and enjoying white-glove support from the CDVantage trade desk.

View Today's Full List of CD Offerings here

Our CD Inventory List is updated daily and contains selections from institutions across the nation. Each CD below is from a different financial institution allowing for maximized federal deposit insurance of $250,000.00 per account at each institution.

CD Rate Table

| CD Rate APY* |

Interest Frequency |

Term (Months) |

Maturity Date |

Earliest Settlement Date |

Minimum Investment |

Amount Available |

| 3.400% |

Monthly |

6 |

06-11-2026 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.300% |

Monthly |

6 |

06-11-2026 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.300% |

Monthly |

6 |

06-11-2026 |

12-12-2025 |

$200,000 |

$250,000 |

| 3.600% |

Monthly |

6 |

06-11-2026 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.300% |

Monthly |

9 |

09-11-2026 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.450% |

Monthly |

9 |

09-11-2026 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.300% |

Monthly |

9 |

09-11-2026 |

12-12-2025 |

$200,000 |

$250,000 |

| 3.400% |

Monthly |

9 |

09-11-2026 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.350% |

Monthly |

12 |

12-11-2026 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.400% |

Monthly |

12 |

12-11-2026 |

12-12-2025 |

$200,000 |

$250,000 |

| 3.400% |

Monthly |

12 |

12-11-2026 |

12-12-2025 |

$200,000 |

$250,000 |

| 3.600% |

Monthly |

12 |

12-11-2026 |

12-12-2025 |

$100,000 |

$300,000 |

| 3.400% |

Monthly |

12 |

12-11-2026 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.400% |

Monthly |

15 |

03-11-2027 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.400% |

Monthly |

18 |

06-11-2027 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.350% |

Monthly |

18 |

06-11-2027 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.400% |

Monthly |

18 |

06-11-2027 |

12-12-2025 |

$200,000 |

$250,000 |

| 3.400% |

Monthly |

24 |

12-11-2027 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.350% |

Monthly |

24 |

12-11-2027 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.300% |

Monthly |

24 |

12-11-2027 |

12-12-2025 |

$200,000 |

$300,000 |

| 3.650% |

Semi |

24 |

12-17-2027 |

12-19-2025 |

$100,000 |

$250,000 |

| 3.650% |

Semi |

24 |

12-17-2027 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.650% |

Semi |

24 |

12-17-2027 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.600% |

Monthly |

24 |

12-18-2027 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.700% |

Monthly |

24 |

12-20-2027 |

12-19-2025 |

$100,000 |

$250,000 |

| 3.600% |

Semi |

24 |

12-20-2027 |

12-19-2025 |

$100,000 |

$250,000 |

| 3.550% |

Semi |

24 |

12-17-2027 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.550% |

Quarterly |

24 |

12-17-2027 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.650% |

Semi |

24 |

12-23-2027 |

12-23-2025 |

$100,000 |

$250,000 |

| 3.300% |

Monthly |

30 |

06-11-2028 |

12-12-2025 |

$200,000 |

$250,000 |

| 3.300% |

Monthly |

30 |

06-11-2028 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.400% |

Monthly |

30 |

06-11-2028 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.400% |

Monthly |

33 |

09-05-2028 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.350% |

Monthly |

36 |

12-11-2028 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.400% |

Monthly |

36 |

12-11-2028 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.300% |

Monthly |

36 |

12-11-2028 |

12-12-2025 |

$200,000 |

$250,000 |

| 3.650% |

Semi |

36 |

12-18-2028 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.650% |

Semi |

36 |

12-18-2028 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.600% |

Monthly |

36 |

12-18-2028 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.650% |

Semi |

36 |

12-18-2028 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.500% |

Semi |

36 |

12-19-2028 |

12-19-2025 |

$100,000 |

$250,000 |

| 3.650% |

Semi |

36 |

12-26-2028 |

12-23-2025 |

$100,000 |

$250,000 |

| 3.450% |

Monthly |

48 |

12-11-2029 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.750% |

Semi |

48 |

12-17-2029 |

12-17-2025 |

$100,000 |

$1,000,000 |

| 3.750% |

Semi |

48 |

12-17-2029 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.700% |

Monthly |

48 |

12-17-2029 |

12-17-2025 |

$100,000 |

$250,000 |

| 3.650% |

Monthly |

48 |

12-19-2029 |

12-19-2025 |

$100,000 |

$250,000 |

| 3.750% |

Semi |

48 |

12-24-2029 |

12-23-2025 |

$100,000 |

$250,000 |

| 3.500% |

Monthly |

48 |

12-24-2029 |

12-23-2025 |

$100,000 |

$250,000 |

| 3.550% |

Monthly |

49 |

01-11-1930 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.500% |

Monthly |

60 |

12-11-1930 |

12-12-2025 |

$100,000 |

$250,000 |

| 3.750% |

Semi |

60 |

12-17-1930 |

12-17-2025 |

$100,000 |

$1,000,000 |

| 3.750% |

Semi |

60 |

12-17-1930 |

12-17-2025 |

$100,000 |

$1,000,000 |

| 3.700% |

Monthly |

60 |

12-17-1930 |

12-17-2025 |

$100,000 |

$1,000,000 |

| 3.750% |

Semi |

60 |

12-17-1930 |

12-17-2025 |

$100,000 |

$1,000,000 |

| 3.600% |

Monthly |

60 |

12-18-1930 |

12-18-2025 |

$100,000 |

$1,000,000 |

| 3.650% |

Semi |

60 |

12-19-1930 |

12-19-2025 |

$100,000 |

$1,000,000 |

| 3.750% |

Semi |

60 |

12-23-1930 |

12-23-2025 |

$100,000 |

$1,000,000 |

Legal Disclosures: Rates and APY

Rates: All CDs offered are insured by the FDIC or NCUA and are subject to applicable federal insurance limits. Furthermore, as a condition of issuance, each institution meets FDIC or NCUA guidelines governing the issuance of brokered deposits. Rates are to be treated as "Subject" offerings due to availability. All rates offered are net of any fees.

APY: Annual Percentage Yield (APY), established by the Board of Governors of the Federal Reserve System for the uniform quotation of deposit interest rates. The APY is the yield your deposit will earn over the term of a year. It refers to your income earned. The APY is unique because it takes compounding into account. Compounding is the the process of receiving interest-on-interest. The quoted APY tells you how much you are actually making on your money.

*Annual Percentage Yield: Minimum Deposit of $100,000. A penalty may be imposed for early withdrawal based on market conditions. Offerings subject to availability. Rates are current as of 12/12/2025. Offer may be modified or discontinued without notice.

About Federal Deposit Insurance

The FDIC and NCUA provide deposit insurance to protect your money. Your deposits are insured up to the maximum allowable by law at each Federally Insured financial institution. By purchasing CDs from multiple banks and credit unions nationwide through our unique online portal, you can safely invest in nearly an unlimited number of CDs, knowing that each one is Federally Insured up to the maximum amount allowable by law.

It is important to note that the FDIC and NCUA aggregate all accounts that a customer has in a financial depository institution when they calculate the insured limit. Customers need to consider any accounts held outside of their CDVantage account when considering purchasing a CD to assure themselves that they have not exceeded the insurance limit. Here is a helpful calculator the FDIC suggests using when considering an aggregated total (click here).